Member Dues

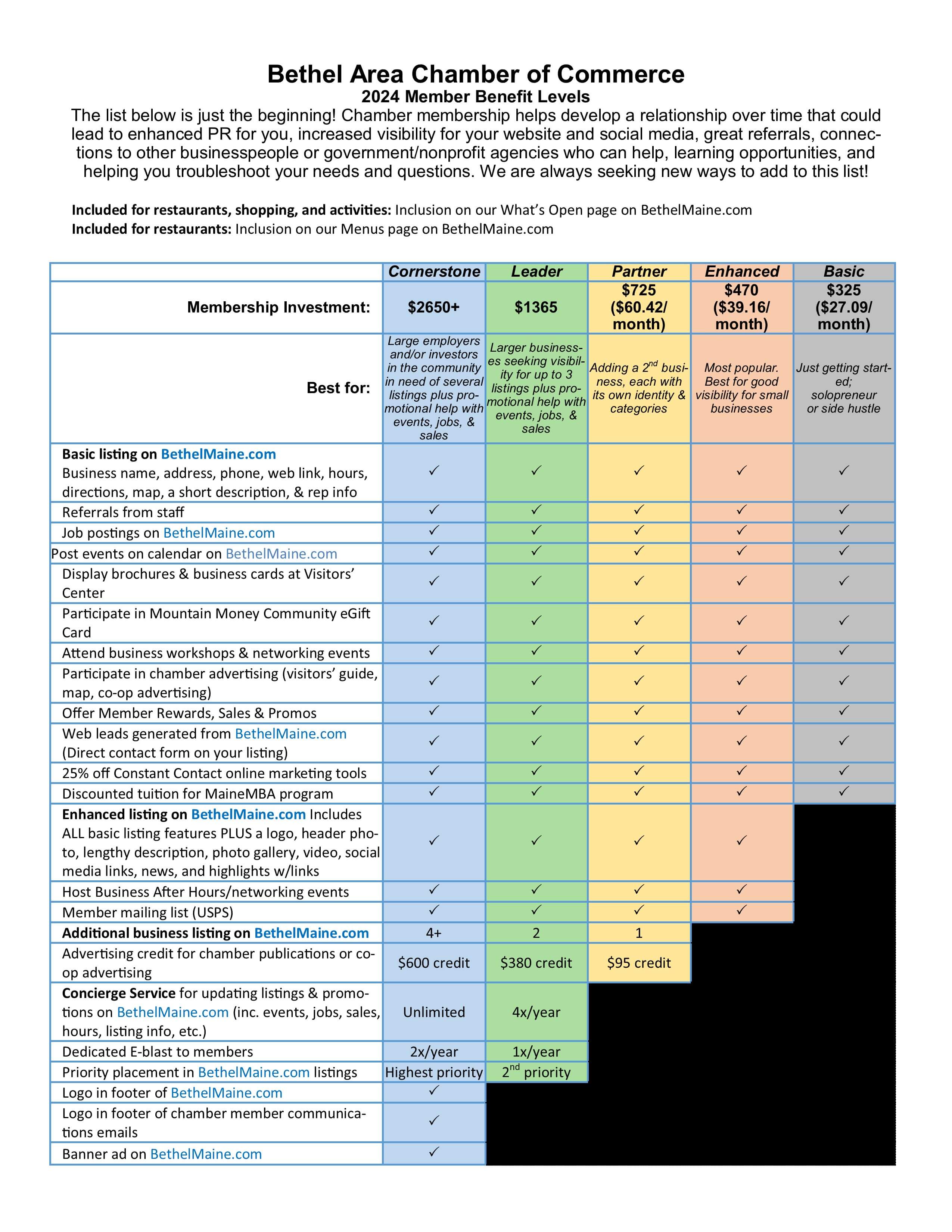

2024 Member Benefit Levels

The list below is just the beginning! Chamber membership helps develop a relationship over time that could lead to enhanced PR for you, increased visibility for your website and social media, great referrals, connections to other businesspeople or government/nonprofit agencies who can help, learning opportunities, and helping you troubleshoot your needs and questions. We are always seeking new ways to add to this list!

Included for restaurants, shopping, and activities: Inclusion on our What’s Open page on BethelMaine.com

Included for restaurants: Inclusion on our Menus page on BethelMaine.com

Payment

Flexible payment plans are available – monthly, quarterly, or other plan designed to work with your cash flow. Member must provide a bank routing and account numbers (preferred) or credit/debit card.

Money-Back Guarantee for New Members

We believe that membership in the Bethel Area Chamber of Commerce is an excellent investment, and that members will believe that too, if they are making maximum use of their benefits. As a result, the BACC offers a First-year Money-back Guarantee.

If a member does the following, and still doesn’t think dues are worth it to them, the member can receive their first year’s dues back.

- Meet with a staff member at your business or in the chamber office to learn how to utilize all the membership tools

- Log in to www.bethelmaine.com to use the tools available to them at the membership level in which they’ve invested

- Attend at least two networking events/workshops

- Volunteer a few hours at an event over the course of the year.

Recruit a New Member and Earn $100 Credit

Know a business which you think would benefit from chamber membership? Refer the owner to us, and if he/she joins, YOU earn a $100 to be used on marketing, advertising, or sponsorship.

Membership Bylaws

Article I, Section 3: Area

The primary geographic area covered will be the towns/townships of Bethel, Greenwood, Newry, Woodstock, Albany Township, Andover, Gilead, Hanover, Mason Township, Milton Plantation & Upton.

The following are excerpts from the BACC Bylaws, Article II, Membership and Dues

Section 2: Membership Investments

Membership investments shall be at such rates, schedule or formula, and may be from time prescribed by the Board, payable annually on January 1. New members must pay a full year investment when initiating membership (regardless of the month they join), and upon the beginning of the chamber’s next fiscal year, the chamber will prorate the member’s dues to reflect the date in which they originally joined. Members that have been a member in the previous calendar year are responsible for one (1) year’s investment regardless of the month in which they invest. At no time will any portion of the annual membership investment be refunded.

Section 3: Admission of Members

1.) If physically located within the towns/townships listed in Article I, Section 3, an individual or business desiring to become a member of the Chamber shall fill out a membership application and submit it with appropriate payment to the chamber office.

a. If physically located outside the towns/townships listed in Article I, Section 3, the business seeking membership must submit a written application. The application will be reviewed and voted on by the board. The board of directors may accept or refuse membership to any business outside of our defined membership area for any reason. Dues payment shall be made after acceptance is decided.

Membership will be without regard to race, creed, religion, sex, sexual orientation, nationality, or political affiliation.